All Categories

Featured

Table of Contents

Prostock-Studio/ GOBankingRates' content group is devoted to bringing you unbiased evaluations and info. We make use of data-driven methodologies to evaluate economic services and products - our evaluations and scores are not influenced by marketers. You can review more about our editorial guidelines and our product or services evaluate methodology. Boundless banking has recorded the interest of several in the personal financing world, promising a path to financial liberty and control.

Infinite financial refers to an economic approach where a private becomes their very own lender. This idea revolves around making use of entire life insurance policy policies that collect money value gradually. The insurance holder can obtain against this money worth for numerous monetary demands, efficiently loaning money to themselves and settling the policy on their very own terms.

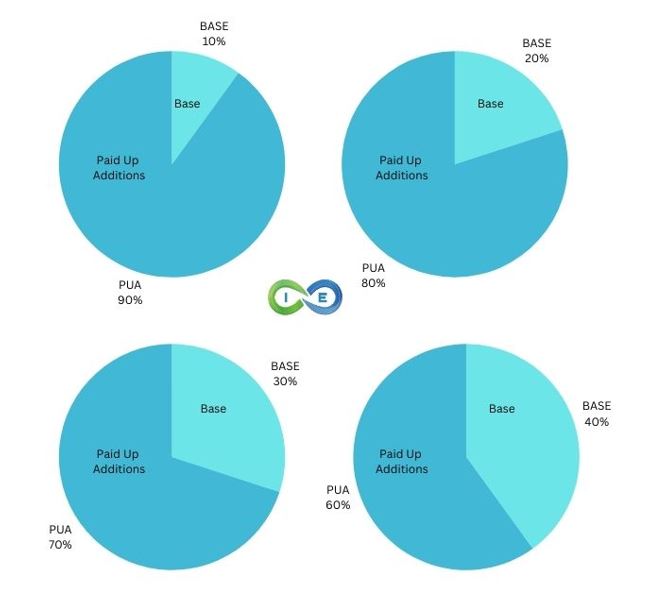

This overfunding increases the growth of the policy's money worth. Boundless banking supplies several benefits.

Is Infinite Wealth Strategy a better option than saving accounts?

It entails making use of a whole life insurance plan to create an individual funding system. Its efficiency depends on numerous factors, including the plan's framework, the insurance policy business's efficiency and exactly how well the technique is taken care of.

It can take numerous years, often 5-10 years or even more, for the cash money worth of the plan to expand adequately to start obtaining versus it efficiently. This timeline can differ depending on the plan's terms, the costs paid and the insurance business's performance.

Leverage Life Insurance

As long as premiums are existing, the insurance holder merely calls the insurer and demands a funding against their equity. The insurer on the phone will not ask what the car loan will certainly be made use of for, what the earnings of the consumer (i.e. policyholder) is, what various other properties the person may need to function as collateral, or in what timeframe the person plans to pay back the financing.

Unlike describe life insurance policy products, which cover only the beneficiaries of the insurance holder in case of their death, entire life insurance covers a person's entire life. When structured correctly, whole life plans produce an unique earnings stream that increases the equity in the policy gradually. For further reading on just how this jobs (and on the advantages and disadvantages of entire life vs.

In today's globe, one driven by convenience of consumption, a lot of take for approved our nation's purest beginning concepts: liberty and justice. Many people never ever think just how the products of their financial institution fit in with these merits. We position the basic question, "Do you really feel liberated or justified by running within the restraints of business lines of credit?" Click below if you would love to find an Accredited IBC Expert in your area.

What is Infinite Banking Benefits?

Reduced loan passion over policy than the traditional loan items obtain collateral from the wholesale insurance plan's money or abandonment worth. It is a principle that permits the insurance policy holder to take car loans overall life insurance policy policy. It ought to be readily available when there is a minute financial concern on the person, in which such loans might help them cover the monetary load.

The insurance holder needs to attach with the insurance coverage company to request a funding on the policy. A Whole Life insurance plan can be labelled the insurance policy product that offers protection or covers the individual's life.

It begins when an individual takes up a Whole Life insurance plan. Such plans preserve their worths due to the fact that of their conventional method, and such plans never invest in market tools. Infinite banking is a principle that enables the insurance holder to take up loans on the entire life insurance coverage policy.

Is Whole Life For Infinite Banking a better option than saving accounts?

The cash or the abandonment worth of the whole life insurance policy serves as security whenever taken financings. Intend a specific enrolls for a Whole Life insurance policy policy with a premium-paying term of 7 years and a policy duration of twenty years. The individual took the plan when he was 34 years old.

The collateral derives from the wholesale insurance policy's money or abandonment value. These elements on either extreme of the spectrum of facts are discussed listed below: Limitless financial as an economic technology improves money flow or the liquidity account of the insurance holder.

How does Wealth Management With Infinite Banking compare to traditional investment strategies?

In financial situations and difficulties, one can use such items to get car loans, consequently reducing the problem. It provides the cheapest money expense compared with the conventional finance product. The insurance coverage finance can also be available when the individual is jobless or dealing with wellness concerns. The entire Life insurance policy plan preserves its general value, and its efficiency does not relate to market efficiency.

Generally, acts well if one entirely relies upon financial institutions themselves. These ideas benefit those that possess solid economic cash money flows. Furthermore, one must take only such plans when one is monetarily well off and can take care of the policies costs. Limitless banking is not a scam, however it is the very best thing most people can choose to boost their monetary lives.

How do I qualify for Generational Wealth With Infinite Banking?

When individuals have limitless banking described to them for the initial time it feels like a wonderful and safe way to expand wealth - Self-banking system. The concept of changing the hated financial institution with loaning from on your own makes a lot more sense. It does call for replacing the "hated" bank for the "hated" insurance policy business.

Of course insurance policy firms and their agents like the concept. They developed the sales pitch to offer more whole life insurance.

There are no products to acquire and I will sell you absolutely nothing. You keep all the money! There are 2 major monetary calamities built right into the infinite financial concept. I will subject these defects as we work with the math of how infinite financial actually functions and how you can do far better.

Latest Posts

R Nelson Nash Net Worth

The '10 Steps' To Building Your Own Bank

Is Infinite Banking A Scam