All Categories

Featured

Table of Contents

- – How do I qualify for Infinite Banking Cash Flow?

- – Can I access my money easily with Private Bank...

- – What is the long-term impact of Privatized Ba...

- – How does Bank On Yourself create financial in...

- – Can I use Cash Value Leveraging to fund larg...

- – How do I track my growth with Infinite Banki...

Prostock-Studio/ GOBankingRates' editorial team is devoted to bringing you impartial testimonials and details. We utilize data-driven techniques to evaluate monetary services and products - our reviews and rankings are not affected by advertisers. You can learn more concerning our editorial standards and our services and products assess technique. Unlimited financial has actually recorded the passion of lots of in the individual finance world, promising a path to financial liberty and control.

Limitless financial describes a financial approach where an individual becomes their own lender. This idea revolves around making use of whole life insurance policy policies that build up cash value in time. The insurance policy holder can obtain against this money worth for numerous financial needs, properly loaning money to themselves and settling the policy by themselves terms.

This overfunding accelerates the growth of the policy's cash money worth. Infinite banking supplies many advantages.

How do I qualify for Infinite Banking Cash Flow?

Right here are the response to some concerns you could have. Is infinite financial legit? Yes, infinite financial is a reputable method. It involves utilizing an entire life insurance coverage policy to develop an individual financing system. Its efficiency depends on different elements, including the policy's framework, the insurance policy company's efficiency and just how well the technique is taken care of.

The length of time does boundless financial take? Limitless financial is a long-lasting approach. It can take numerous years, often 5-10 years or more, for the cash money worth of the policy to grow sufficiently to begin obtaining against it properly. This timeline can differ relying on the policy's terms, the costs paid and the insurer's efficiency.

Can I access my money easily with Private Banking Strategies?

So long as premiums are existing, the insurance policy holder merely calls the insurance business and demands a financing against their equity. The insurance provider on the phone will not ask what the car loan will certainly be made use of for, what the revenue of the consumer (i.e. insurance holder) is, what various other possessions the individual might need to function as collateral, or in what timeframe the individual plans to pay back the finance.

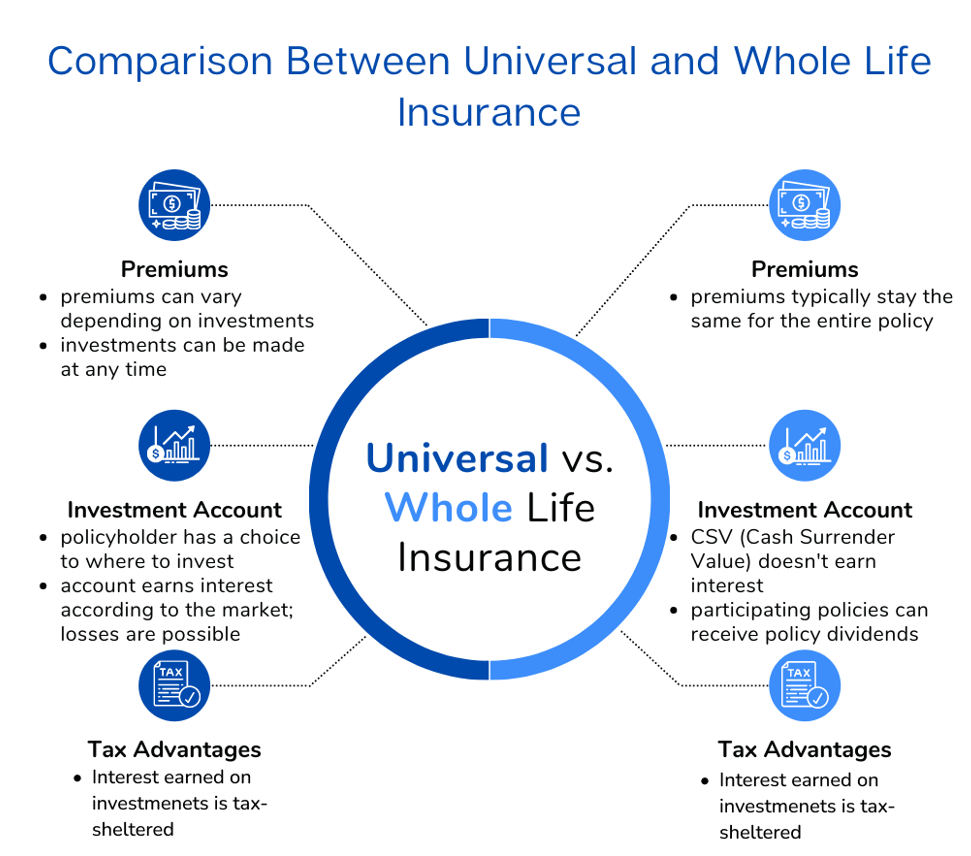

In comparison to label life insurance coverage items, which cover only the beneficiaries of the insurance policy holder in case of their fatality, entire life insurance covers a person's entire life. When structured appropriately, entire life policies generate a special income stream that increases the equity in the policy gradually. For more reading on exactly how this works (and on the pros and disadvantages of entire life vs.

In today's world, one driven by convenience of usage, as well numerous consider given our country's purest beginning principles: liberty and justice. Lots of people never think exactly how the items of their bank fit in with these merits. We position the simple concern, "Do you feel liberated or warranted by running within the restraints of commercial lines of credit rating?" Click on this link if you want to locate an Authorized IBC Expert in your location.

What is the long-term impact of Privatized Banking System on my financial plan?

It is a principle that permits the insurance holder to take finances on the whole life insurance coverage policy. It needs to be readily available when there is a minute monetary worry on the person, where such lendings may aid them cover the monetary lots.

Such surrender worth functions as money collateral for a loan. The policyholder requires to connect with the insurance policy business to ask for a loan on the policy. A Whole Life insurance policy policy can be labelled the insurance coverage product that supplies protection or covers the person's life. In case of the feasible fatality of the individual, it offers economic safety to their member of the family.

The policy might require month-to-month, quarterly, or yearly payments. It begins when a specific uses up a Whole Life insurance plan. Such policies may spend in business bonds and federal government safety and securities. Such plans keep their values due to the fact that of their traditional technique, and such plans never ever spend in market tools. For that reason, Infinite financial is a concept that allows the insurance policy holder to take up loans on the whole life insurance plan.

How does Bank On Yourself create financial independence?

The cash money or the abandonment value of the whole life insurance coverage works as collateral whenever taken finances. Intend a private enrolls for a Whole Life insurance policy plan with a premium-paying regard to 7 years and a policy period of twenty years. The specific took the policy when he was 34 years old.

The collateral obtains from the wholesale insurance coverage policy's money or abandonment value. These aspects on either extreme of the range of truths are discussed listed below: Infinite banking as a financial technology improves cash money circulation or the liquidity profile of the policyholder.

Can I use Cash Value Leveraging to fund large purchases?

The insurance policy funding can additionally be readily available when the individual is unemployed or facing health issues. The Whole Life insurance plan retains its total value, and its performance does not link with market efficiency.

Usually, acts well if one completely counts on banks themselves. These principles help those who possess strong financial cash money circulations. In addition, one need to take only such policies when one is monetarily well off and can handle the plans premiums. Unlimited banking is not a fraud, yet it is the very best point lots of people can select to improve their financial lives.

How do I track my growth with Infinite Banking?

When individuals have boundless banking described to them for the first time it looks like a wonderful and risk-free means to expand riches - Infinite Banking vs traditional banking. The concept of changing the despised financial institution with loaning from on your own makes a lot even more feeling. However it does need changing the "disliked" financial institution for the "disliked" insurance provider.

Of program insurance coverage business and their representatives like the concept. They invented the sales pitch to sell even more entire life insurance.

There are no products to get and I will offer you nothing. You keep all the cash! There are 2 significant monetary catastrophes built right into the unlimited banking principle. I will reveal these defects as we overcome the mathematics of how unlimited banking truly functions and exactly how you can do far better.

Table of Contents

- – How do I qualify for Infinite Banking Cash Flow?

- – Can I access my money easily with Private Bank...

- – What is the long-term impact of Privatized Ba...

- – How does Bank On Yourself create financial in...

- – Can I use Cash Value Leveraging to fund larg...

- – How do I track my growth with Infinite Banki...

Latest Posts

R Nelson Nash Net Worth

The '10 Steps' To Building Your Own Bank

Is Infinite Banking A Scam

More

Latest Posts

R Nelson Nash Net Worth

The '10 Steps' To Building Your Own Bank

Is Infinite Banking A Scam