All Categories

Featured

Table of Contents

A PUAR permits you to "overfund" your insurance plan right up to line of it ending up being a Modified Endowment Contract (MEC). When you utilize a PUAR, you rapidly boost your money worth (and your death advantage), therefore boosting the power of your "bank". Better, the even more cash money worth you have, the greater your interest and returns payments from your insurance provider will be.

With the surge of TikTok as an information-sharing system, monetary recommendations and strategies have actually located an unique method of spreading. One such strategy that has been making the rounds is the limitless financial idea, or IBC for brief, amassing recommendations from stars like rap artist Waka Flocka Fire. Nevertheless, while the approach is currently prominent, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the globe.

Is Borrowing Against Cash Value a better option than saving accounts?

Within these policies, the money worth grows based on a price set by the insurer (Generational wealth with Infinite Banking). Once a significant cash money worth accumulates, policyholders can acquire a cash money value funding. These fundings differ from traditional ones, with life insurance policy offering as collateral, indicating one might lose their protection if loaning exceedingly without ample cash money value to sustain the insurance expenses

And while the appeal of these plans appears, there are natural limitations and dangers, necessitating attentive cash money worth tracking. The strategy's authenticity isn't black and white. For high-net-worth individuals or company owner, particularly those using strategies like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound growth can be appealing.

The appeal of unlimited banking does not negate its challenges: Expense: The foundational need, a permanent life insurance plan, is more expensive than its term equivalents. Qualification: Not every person gets whole life insurance due to strenuous underwriting procedures that can exclude those with particular health and wellness or way of living conditions. Intricacy and threat: The intricate nature of IBC, paired with its risks, might deter lots of, especially when simpler and much less high-risk options are offered.

What is the long-term impact of Infinite Banking on my financial plan?

Designating around 10% of your monthly revenue to the plan is simply not possible for the majority of individuals. Component of what you check out below is just a reiteration of what has actually currently been said above.

Prior to you obtain on your own into a circumstance you're not prepared for, know the complying with initially: Although the idea is typically sold as such, you're not in fact taking a loan from yourself. If that held true, you wouldn't need to settle it. Rather, you're borrowing from the insurance coverage business and have to settle it with interest.

Some social media articles advise using cash worth from whole life insurance to pay down credit card debt. When you pay back the car loan, a section of that passion goes to the insurance policy firm.

For the very first numerous years, you'll be settling the commission. This makes it exceptionally difficult for your plan to build up value during this time around. Entire life insurance coverage prices 5 to 15 times much more than term insurance policy. Many people just can not manage it. So, unless you can manage to pay a few to numerous hundred bucks for the following decade or more, IBC won't help you.

How can Tax-free Income With Infinite Banking reduce my reliance on banks?

If you call for life insurance, here are some useful tips to think about: Think about term life insurance. Make certain to shop about for the finest rate.

Envision never ever having to stress concerning bank lendings or high passion rates once again. That's the power of limitless banking life insurance policy.

There's no set lending term, and you have the freedom to make a decision on the repayment timetable, which can be as leisurely as paying off the loan at the time of fatality. Infinite wealth strategy. This flexibility includes the maintenance of the fundings, where you can go with interest-only repayments, maintaining the car loan balance level and workable

Holding cash in an IUL repaired account being credited passion can commonly be far better than holding the cash money on down payment at a bank.: You have actually constantly dreamed of opening your very own pastry shop. You can obtain from your IUL plan to cover the first expenses of leasing an area, acquiring devices, and employing staff.

What do I need to get started with Infinite Banking Retirement Strategy?

Personal fundings can be obtained from typical financial institutions and lending institution. Here are some bottom lines to think about. Bank card can supply a versatile method to obtain cash for extremely short-term periods. Obtaining cash on a credit report card is normally extremely expensive with annual percent prices of passion (APR) frequently reaching 20% to 30% or even more a year.

Latest Posts

R Nelson Nash Net Worth

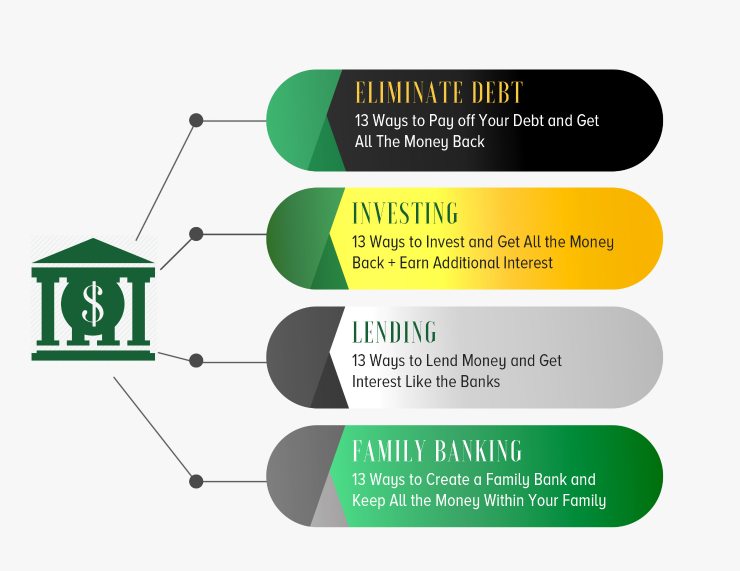

The '10 Steps' To Building Your Own Bank

Is Infinite Banking A Scam